Brand Case Study

WHAT WE CREATED

- Brand Planning

- Social Media

- Promotions

- Point of Purchase

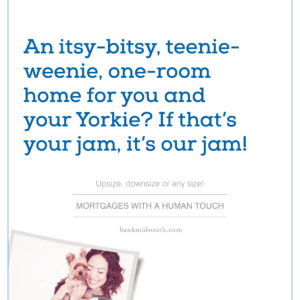

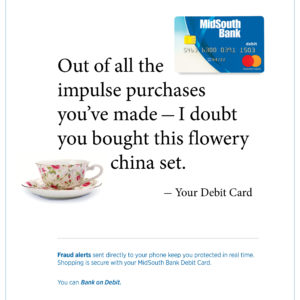

- Print Advertising

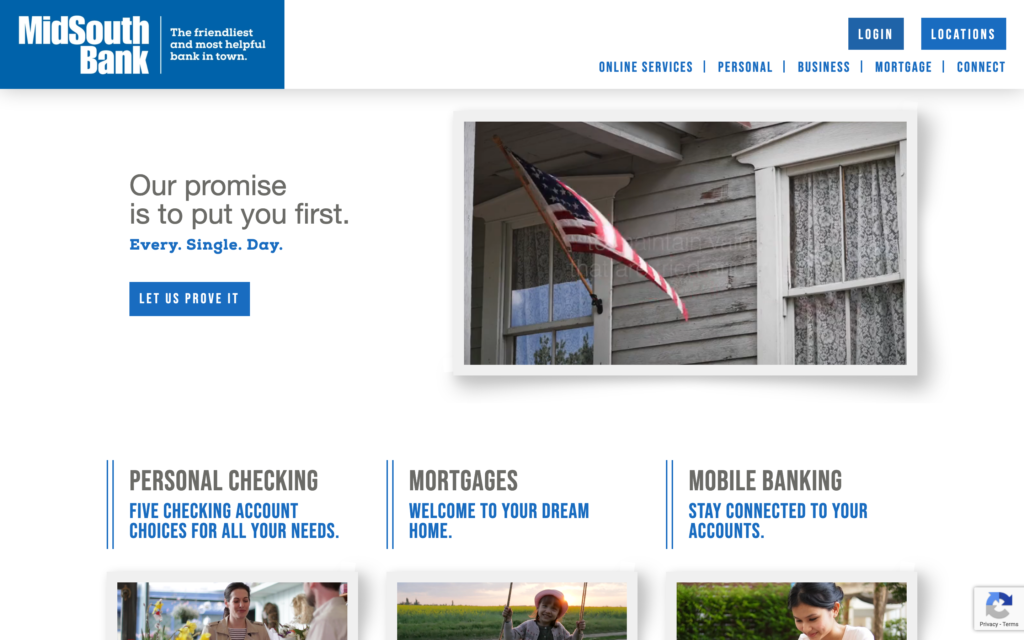

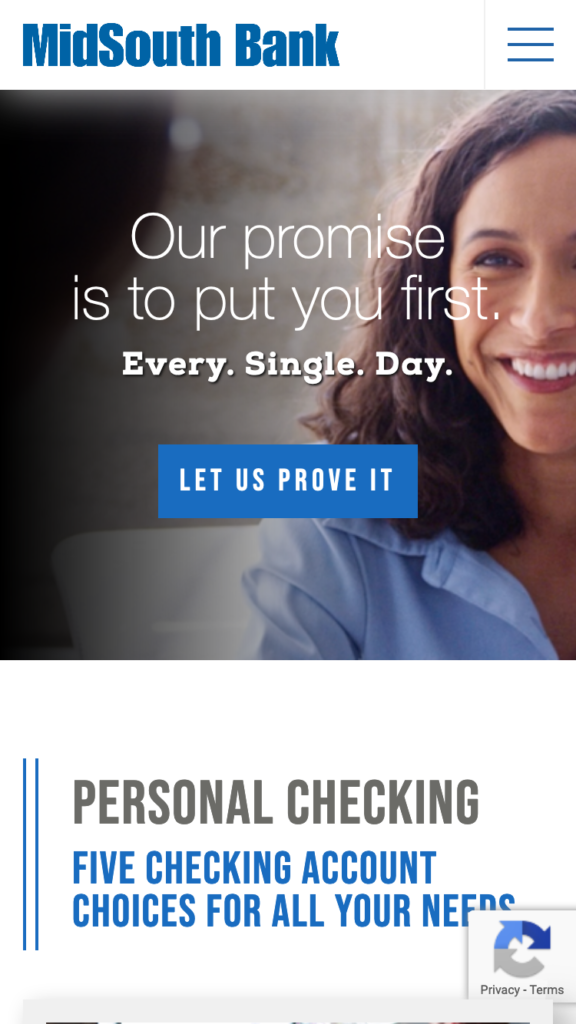

- Website Design

- Digital Marketing

- Video Content

An uninspired audience

MidSouth Bank opened its doors and 1912 and from the start has embraced a helpful brand of banking: responsive service focused on valued relationships. MidSouth Bank strives to establish its bank as an integral part of each market they serve – large enough to offer comprehensive financial solutions, yet small enough to make the financial goals of its customers its highest priority. While existing customer satisfaction was very strong, MidSouth Bank needed to grow new account deposits exponentially, which required moving outside the comfort of their branch walls and tapping into new customers – while also competing against bigger banks, credit unions, online banks, and non-traditional financial partners impacting their growing communities.

Unexpected insights leading to original ideas

Audience insights confirmed customers wanted a bank that would exceed expectations throughout their financial journey. They needed a financial teacher, a problem solver, a promise keeper and a trusted friend – a bank that delivers on customer service, convenience, saving/making money and loyalty. The problem with big banks is that they treat people like numbers, not people. And that was enough of an insight to make MidSouth raise itself from the rest. Our, “The friendliest and most helpful bank in town” concept was a rally cry to prove themselves. If a potential client called the bank, they answered the phone with a real human. If they walked into the bank, a real human greeted them. We kept the whole transaction real, with real people trained to be able to handle any question a consumer might have. Add in a few new technologies – mobile banking, online direct deposit and no-fees for most transactions and you make the point. Prove yourself and people will come.

The audience is inspired and is buying

And come they did. The new MidSouth Bank brand and product/services campaigns delivered on the brand promise. Year-over-year new account openings were up over 33%, and more than 470 new loans were opened. Furthermore, web analytics identified over 6.2k new visitors, while bounce rates dropped 63%.