Brand Case Study

WHAT WE CREATED

- Brand Planning

- Television

- Website Design

- Point-of-Purchase

- Social Media

- Digital Media

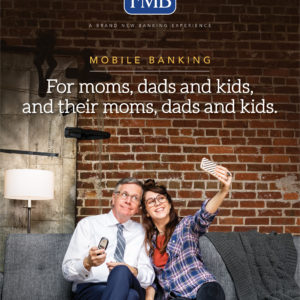

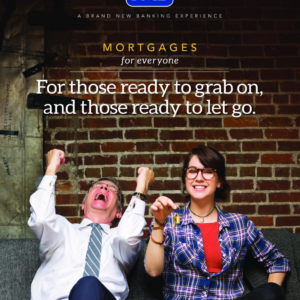

- Print Advertising

- Collateral

- Promotions

An uninspired audience

In a fast moving, quick evolving world, a brand cannot become complacent if it wishes to compete and prosper to retain and attract consumers. For Farmers & Merchants Bank, market share was being stolen by other banks offering better technology and newer products and services. Their current customers had matured and were not engaging with the brand, and younger customers were non-existent. FMB had become complacent and left behind.

Unexpected insights leading to original ideas

We engaged with our audiences, young adults and FMB’s current mature customer base and what we found was that indeed, FMB had nothing desirable for each group. And, they were perceived as “Boring.” Communication for younger audiences is not a personal transaction, it’s done through technology. And mature audiences had no reason to buy into the brand because they were content and didn’t need new products or services – so they thought. FMB reacted quickly and invested in new technology, products, services and their own culture. Then it was a matter of convincing younger audiences and reinvigorating mature audiences of these new technologies, products and services.

The audience is inspired and is buying

Numbers mean everything to banks. Mobile banking grew 260% Deposits grew 357%. Online banking was up 92% New accounts grew 56% Mortgage lending grew 33%. FMB was relevant again and back in the banking game.